Ready to explore loan options tailored just for you? Let’s dive into the world of loans.

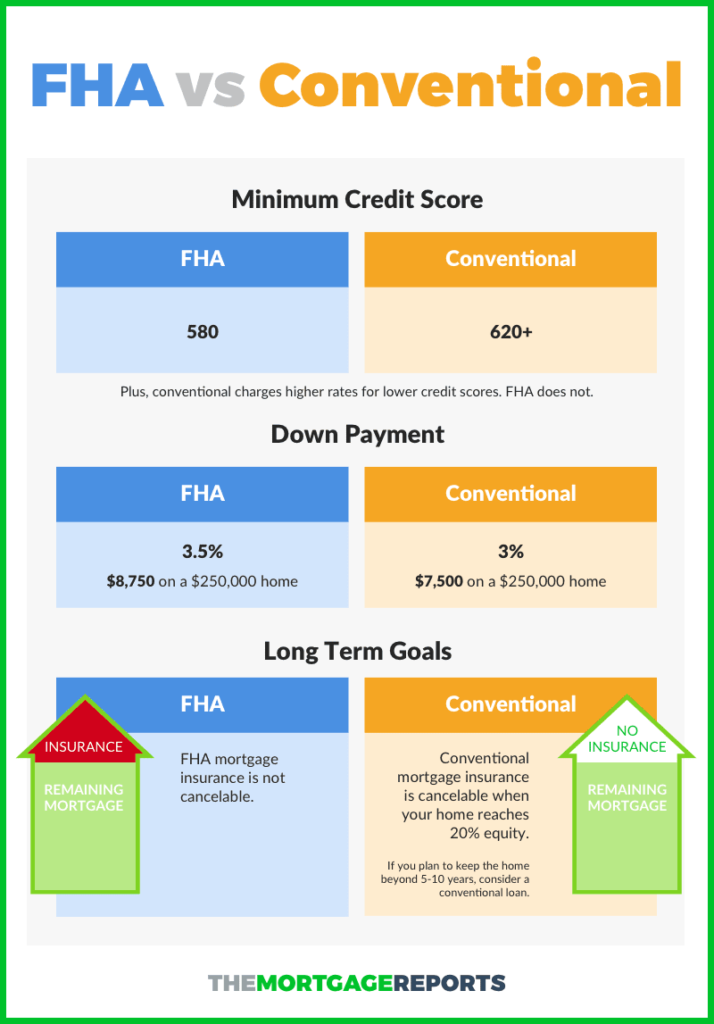

Conventional Loan: where stability meets your aspirations. With a minimum credit score of 620, a 3% down payment, and a track record of two years’ stability, it’s a solid choice.

- Minimum credit score of 620

- Minimum 3% down payment

- 2 years of W2 or 1099 forms

- 2 years of tax returns

- Most recent pay stub when applying for the loan

- Full-time stable employment for at least 2 years

- If changing jobs, it should be in a similar job position, not from a marketing employee to a machine operator).

Feeling the pinch?

FHA Loan might be your ticket to homeownership with a minimal 3.5% down payment. Ideal for those with lower incomes, it requires a credit score of 580. Be ready for added responsibilities, though, with upfront mortgage insurance and a monthly premium.

- Pay a lump sum of money for the mortgage insurance upfront.

- Pay a monthly mortgage insurance premium for the entire 30-year loan term.

Calling our military heroes!

VA Loan, a salute to your service, demands zero down payment. It also offers a good interest rate, but there are loan limits. In Santa Clara County, the loan limit is up to $1,089,300 (refer to this link: https://veteran.com/va-loan-limits-by-county/).

- Documents required are the same as in part 1

- COE (certificate of eligibility)

- DD-214 (access through the military system or contact your superior to request it)

- To be able to rent out the property, the first property must be occupied for at least one year before being rented out.

- To buy a second property, there must be a valid reason: relocation, a larger family, or closer proximity to work.

To compare, check out the handy chart below. While FHA flaunts a lower rate, Conventional loans win in the long run with the potential to ditch mortgage insurance sooner. Your dream home journey begins with the right loan—let’s find yours!