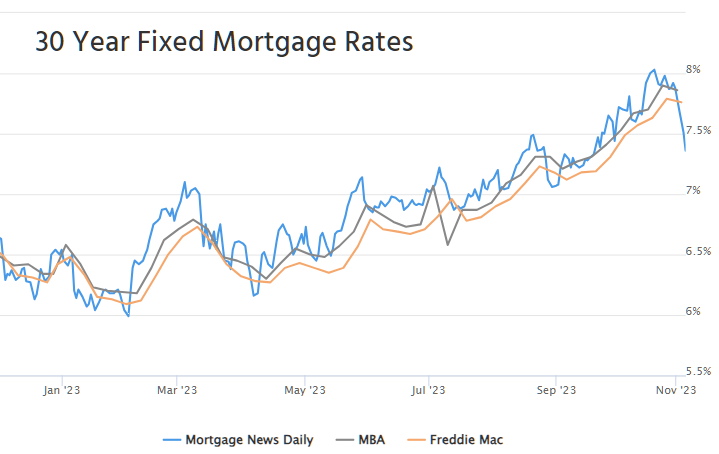

The average top tier 30yr fixed mortgage rate was over 8% as recently as October 19th. At the start of the present week, things weren’t much better at 7.92%.

What a difference a few days make–especially the last 3. The improvement seen on Wed-Fri is the 3rd biggest in well over a decade. And if we throw out March 2020 (as we often do, due to unprecedented volatility relating to the onset of the pandemic), we’re left with only one other example back early November of 2022.

So is this some kind of seasonal pattern? You’d be forgiven for drawing that conclusion, but in both cases, rates had recently surged to new long-term highs and then encountered surprisingly friendly economic data.

Last November it was a low reading in the Consumer Price Index (CPI) that gave investors hope regarding a shift in inflation. Unfortunately, that shift proved to be a head-fake and rates continued lower into February of 2023, it’s been up, up, and away since then.

This time around, scheduled data gets the credit again, but there’s a more robust assortment. The good times began to roll on Wednesday after Treasury announced lower-than-expected auction amounts (lower supply of bonds relative to expectations means lower rates, all other things being equal). The rally gained momentum with economic data at 10am and again with the Fed announcement in the afternoon.

Thursday was mild by comparison, but kept the trajectory intact with help from slightly higher Jobless Claims data, and especially from traders exiting bets on higher rates. In the bond market, the simple act of “no longer betting on higher rates” forces a trader to effectively enter a bet on lower rates.

This morning’s jobs report was in a unique position to cast a deciding vote on the past 2 days of potential exuberance. If jobs came in higher than forecast, the drop in rates would indeed have seemed overly exuberant and we would likely be seeing a decent push back. As it happened, jobs were weaker than forecast. Additionally, the unemployment rate ticked up more than expected and the past few months of jobs gains were revised lower.

To be sure, the labor market is still exceptionally strong, but the rate market had been pricing in something even stronger. Today’s jobs numbers increasingly paint a picture of a labor market that is cooling back down to more historically normal levels. Some economists and pundits are concerned about even more weakness, but we’re not here to pontificate on the future.

All we know is that this has been some of the best 3 days of news for mortgage rates and bonds that we’ve seen since rates first began to launch higher 2 years ago. Granted, the magnitude of the drop is greatly facilitated by the fact rates were at multi-decade highs in the past few weeks, but we’re not complaining.

The average conventional 30yr fixed rate is now back below 7.5% for top tier scenarios. You may see a very wide variety of rates today and early next week. This sort of volatility makes lender offerings more stratified than normal. Some of the lenders quoting rates with discount points are already able to do so in the high 6’s. Laggards are still near 8%.

Source: https://housingbrief.com/