Yes, it is possible to buy a house with a 3% down payment, but the availability of such financing options depends on various factors, including the type of mortgage loan and the lender’s requirements. Here are some common mortgage programs that allow for a 3% down payment:

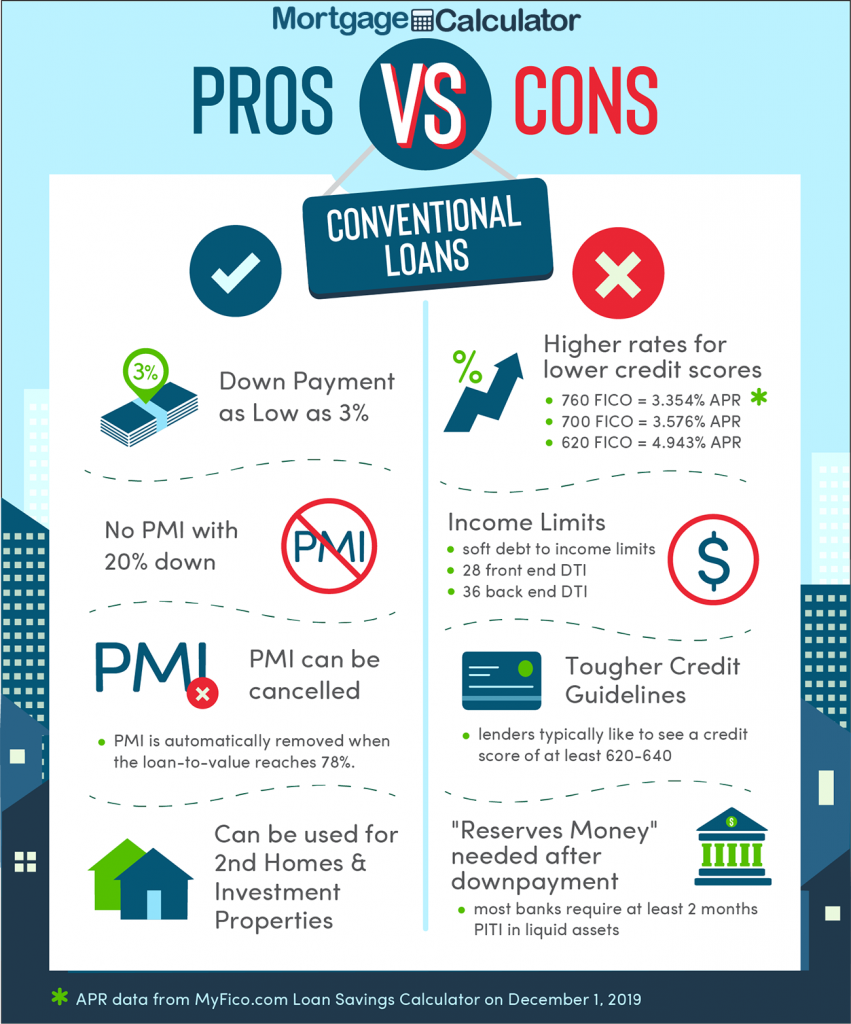

- Conventional Loans:

- Some conventional mortgage programs offer down payment options as low as 3%. These loans are not insured or guaranteed by the government (such as FHA or VA loans) and typically have stricter credit and income requirements.

- FHA Loans:

- The Federal Housing Administration (FHA) offers loans with down payments as low as 3.5%. FHA loans are government-insured and may have more flexible qualification criteria, making them accessible to borrowers with lower credit scores.

- USDA Loans:

- The U.S. Department of Agriculture (USDA) offers loans for eligible rural and suburban homebuyers with zero down payment. While this is not a 3% down payment, it’s worth mentioning for those looking for low or no down payment options.

- State and Local Programs:

- Some state and local housing agencies offer down payment assistance programs that can help homebuyers with their down payment and closing costs. These programs may vary by location.

It’s important to note that a lower down payment often comes with trade-offs. With a smaller down payment, you may be required to pay private mortgage insurance (PMI), which protects the lender in case of default. PMI adds to the overall cost of homeownership.

Before deciding on a mortgage program, it’s advisable to shop around and compare offers from different lenders. Additionally, consider factors such as interest rates, loan terms, and potential fees associated with the mortgage.

Keep in mind that mortgage lending requirements can change, and eligibility criteria may vary among lenders. Working with a mortgage professional or loan officer can help you navigate the process and find the best financing option for your specific situation.